Time Value of Money

Thomas Edison’s Universal Stock Printer

How is Interest Calculated?

“Should I use my student loan money to pay off credit card debt?”

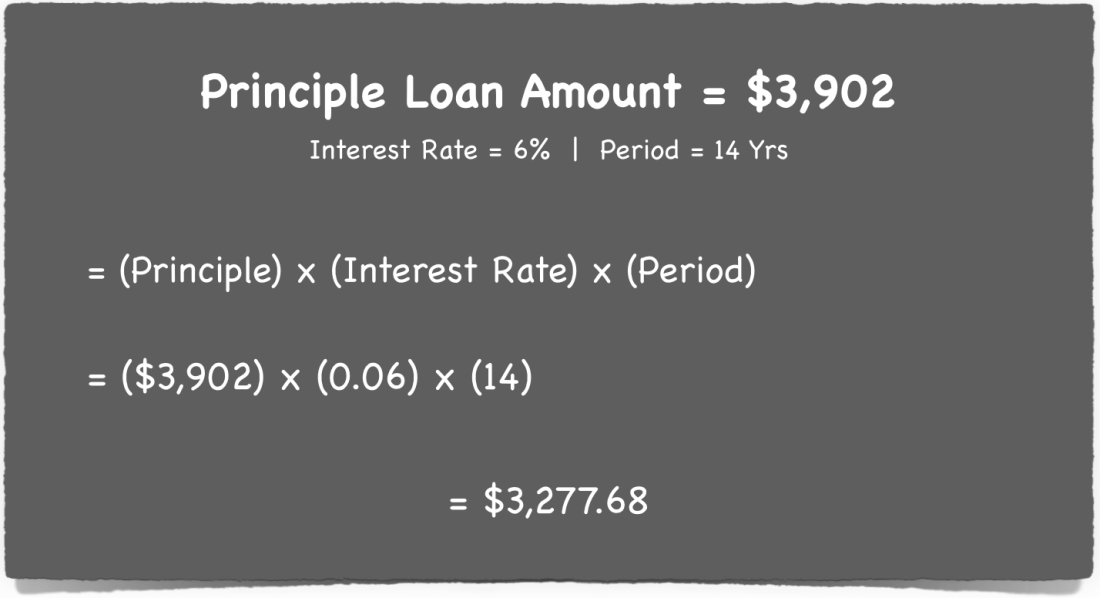

Simple Interest

Example | Simple Interest

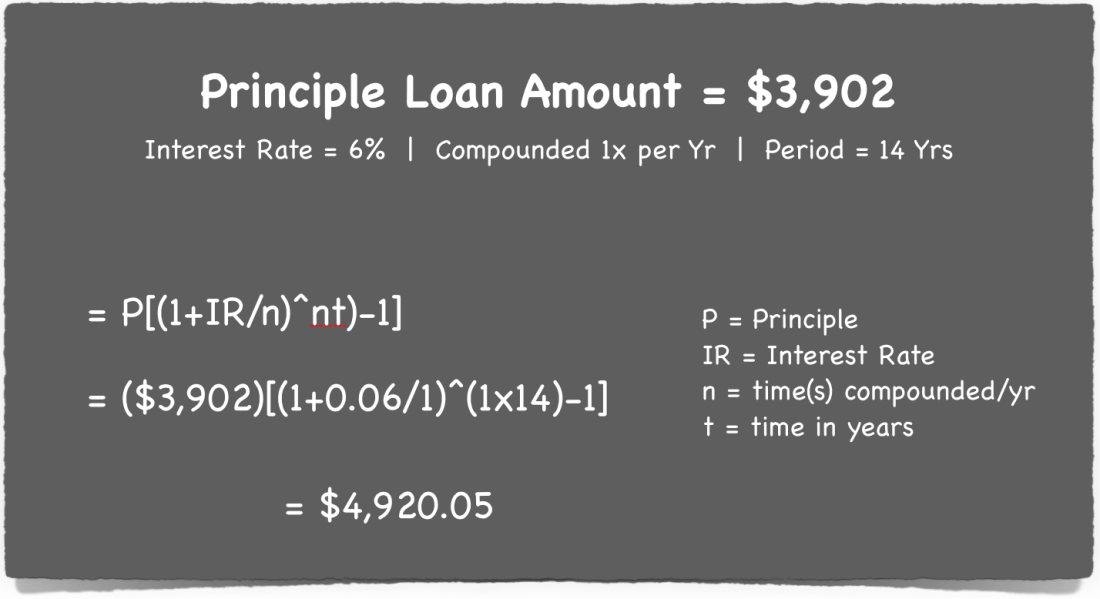

Compound Interest

Example | Compound Interest

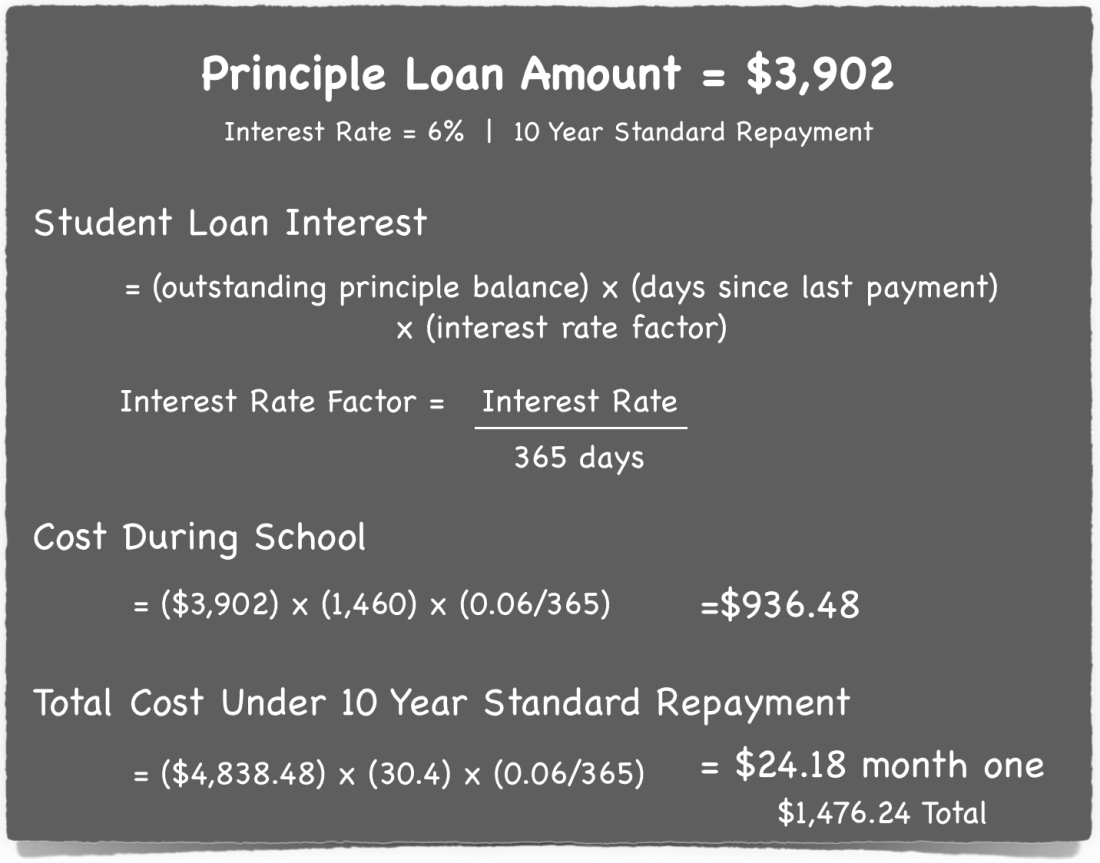

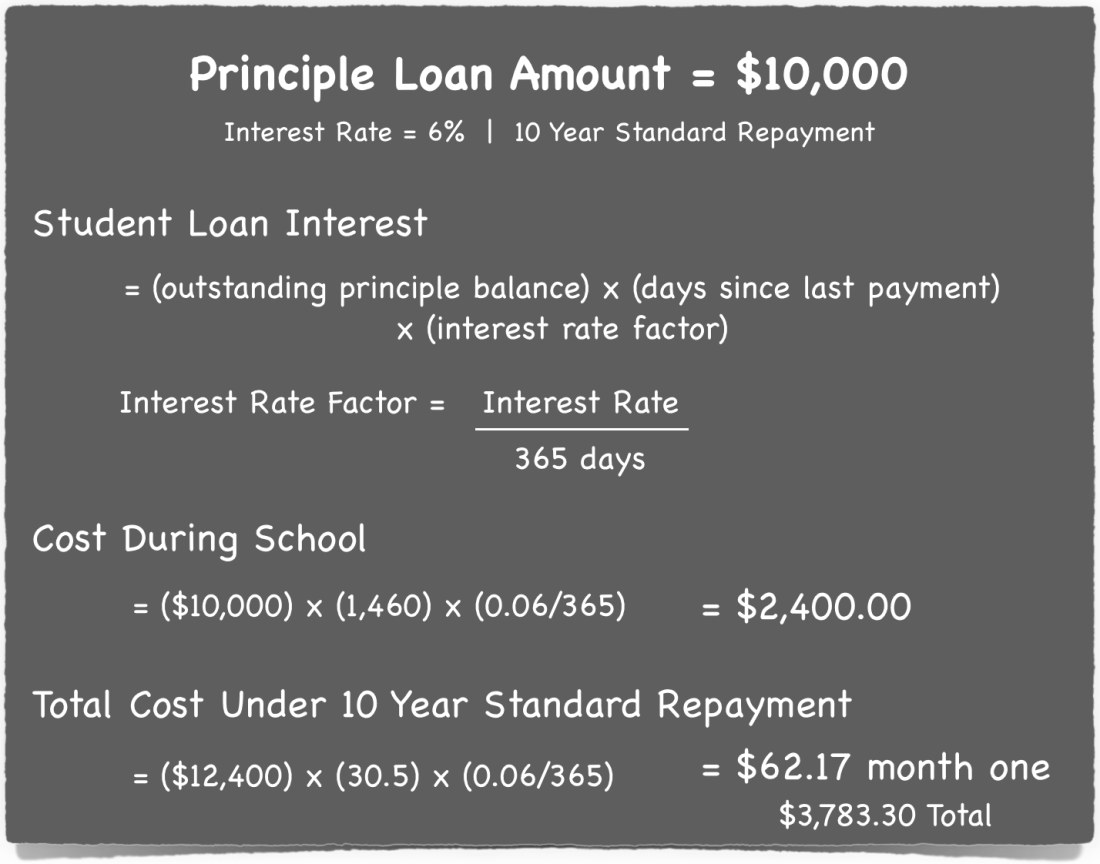

Student Loan Interest

Example | 10 Year Standard Repayment Student Loan Interest

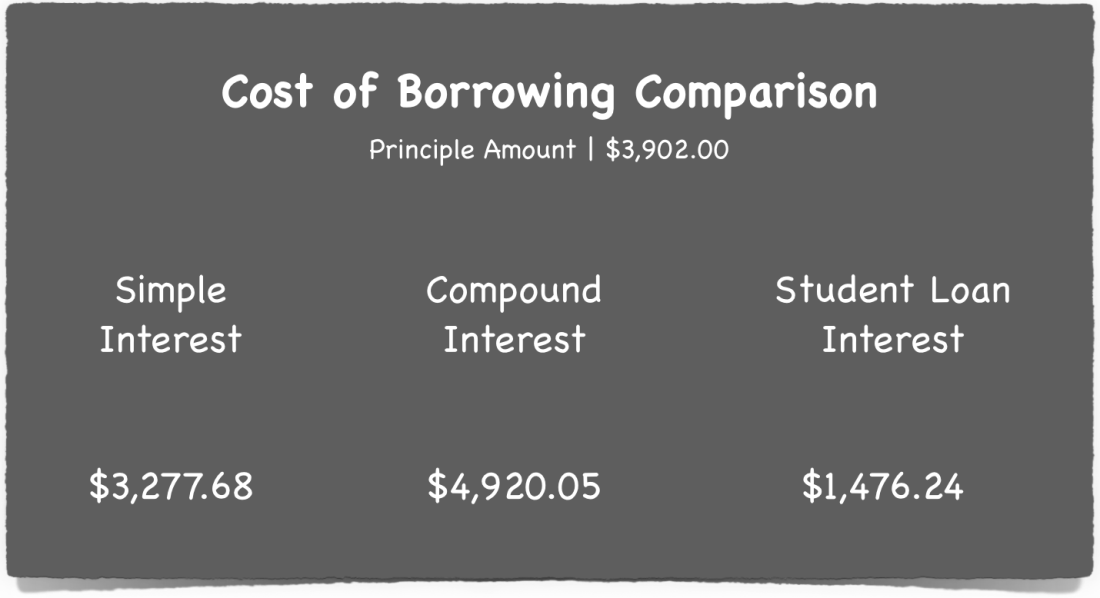

Comparison

Cost of Borrowing Comparison

Case Study

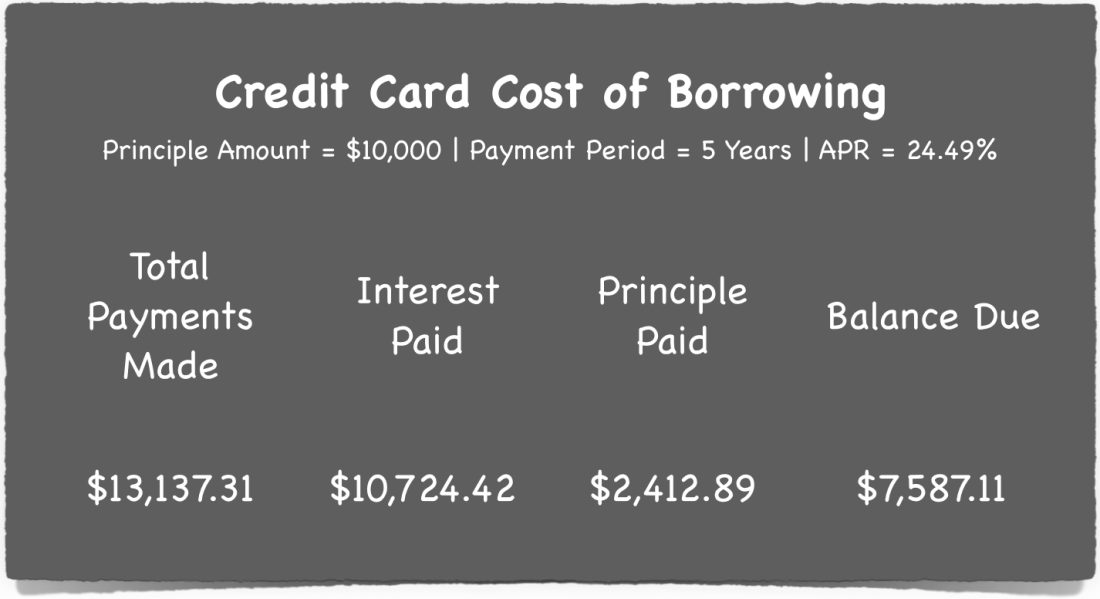

Cost of Money | Credit Card

Figure 1. Credit Card Cost of Borrowing

Cost of Money | Student Loan

Figure 2. Student Loan Cost of Borrowing

What Should Our Student Do?

Figure 3. Cost of Borrowing Comparison

Putting It All Together

Responses

Breaking down finances with real world examples is enlightening! Thanks so much @iwidensky.

I feel like most of the time students are told not to pay off credit card debt with student loans, but with no explanation for why. Thank you for taking the time to explain the math behind the situation. Much appreciated @iwidensky !